Health Insurance vs. Health Care

Fear of the unknown is one of the main motivators to purchase insurance. People are concerned about the unexpected, catastrophic medical events. You may be surprised that health insurance costs are increasing at a rate greater than actual medical expenses.

Paying insurance premiums is not the same as paying for the health care. Insurance companies make a lot of money because they take in much more in premiums than they pay for medical care.

Medical expenses are the cost of the medication, office visits, surgery, etc. When paid for directly, these medical costs are reasonable.

Why is health insurance so expensive?

New health care interventions and medications may be more expensive. However, if exposed to market forces, these prices should come down. This is true for all goods and services, but not health care. Some debate that health care cannot be treated like other goods and services. We have many examples of cost control, while improving the quality of care provided, when health care is exposed to market forces.

A major problem with our healthcare delivery system is that insurance insulates the patient and health care provider from the actual expenses of health care. As a result, a significant portion of health care provided is probably not needed. A common question asked is, “Will my insurance cover this?” A better question to ask is, “Do I need this procedure, lab test, or surgery?”

With the passage of the Affordable Care Act (ACA), many are forced to purchase a high deductible insurance policy. This forces one to question the need for lab tests, diagnostic procedures, and to be more interested in a healthy lifestyle.

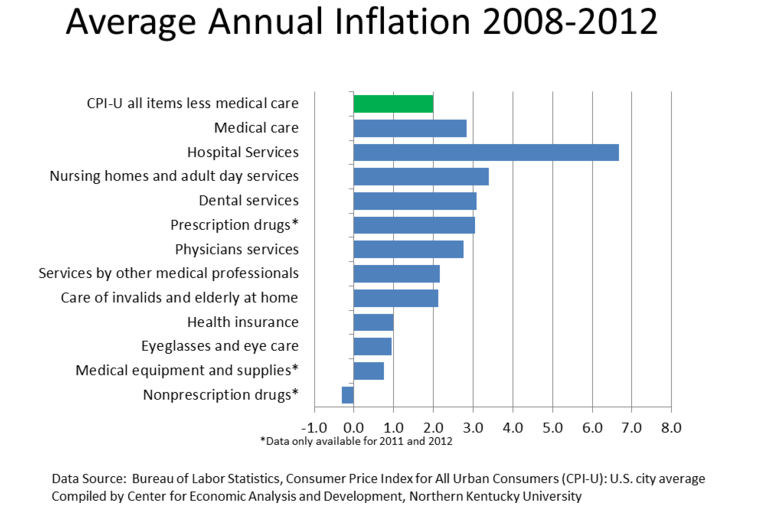

The average annual inflation for health care from 2008-2012 was less than 2%!

Hospital Service inflation was 6.5% during this same period of time.

It is possible to get MRI/CT scans anywhere in the United States for less than $500! Lab tests are less expensive, and many health care providers are migrating towards payment at time of service and charging reasonable prices. Many surgical procedures are very affordable.

Tips for Choosing Health Insurance

Note: Health Insurance premiums are affordable when insurance is only used for the catastrophic and unpredictable expenses. Consider the

Consumer Directed Health Care Model, and compare your plan with

other options.

- Individuals: Ask your employer to explore setting up a Health Reimbursement Arrangement (HRA) or Health Savings Account (HSA). [If they are not aware of this option, contact Kelly Nesbit — Kelly.Nesbit@tasconline.com]

- Small Businesses: Are you self-employed or a business owner with less than 50 employees? Then consider setting up a Health Reimbursement Arrangement (HRA) or Health Savings Account (HSA). Non-profits may also benefit from an HRA or HSA. [Contact Kelly Nesbit (Kelly.Nesbit@tasconline.com) to explore options for setting up an HRA or HSA]

- Large Businesses: If you are able to self-insure, you will be more effective in controlling premium inflation by Educating and Empowering your employees. Their incentives will be aligned appropriately, once they have control of a portion of their health benefit dollars. You may control escalating benefit premiums with a High Deductible policy and either an HRA or HSA. Contact Total Administrative Services Corporation (TASC), www.tasconline.com if you help with your benefits.